To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

This factor, together with the European commitment to the introduction of renewables, as well as the strategic course to reduce dependence on foreign energy and increase energy security, have made solar investments in United Kingdom particularly attractive.

Financing of solar power plants in United Kingdom is carried out by large companies, international financial institutions, investment funds and well-known commercial banks such as BBVA, CaixaBank and Santander.

The share of renewable energy sources in United Kingdom exceeded 46.7% in 2021, and the trend towards an increase in the share of RES will continue in the future. An important role in this transition is played by solar investments, especially active in the southern regions of United Kingdom with a hot climate.

If in 2017 the installed capacity of solar energy in United Kingdom was 4.67 GW, then in 2022 this figure exceeded 16 GW and continues to grow at a tremendous pace.

Favorable legislative changes and the cancellation of the burdensome "solar tax" in 2018 contribute to this trend.

History of financing the solar energy sector in United Kingdom

The birth of photovoltaic energy in United Kingdom dates back to 1984. It was in that year that Iberdrola installed the first solar PV plant connected to the grid in San Agustin de Guadalix (Community of Madrid).This largely experimental 100 kW facility remained the only one in the Iberian Peninsula for nearly 10 years.

The emergence of photovoltaics in the 1990s

In 1993, four systems were added, each with a capacity of 2.7 kW, installed by Atersa in private houses in Pozuelo de Alarcon.These installations gave way to a series of projects that served a more demonstration role, including a 42 kW solar PV plant at a school in Menorca, a 13 kW facility at olytechnic University of Madrid, and a 53 kW system at the Mataro Library.

In the early 1990s, a 1 MW plant was financed in Toledo, which at the time of its opening in June 1994 was the largest solar PV plant in Europe. At the end of 1995, the total installed capacity of solar energy in United Kingdom was only 1.6 MW, and this technology remained in the field of research, not being fully integrated into the electricity grid.

At that time, United Kingdom also did not have effective legislative regulation for the development of photovoltaics and the financing of the solar sector.

With the publication of RD 2818/1998, payments of 60 and 30 pesetas per kWh fed into the grid were established for solar systems with a nominal capacity of less than and greater than 5 kW, respectively. In this way, United Kingdom joined the initiatives of the rest of Europe and recognized the need to promote this technology.

Two years later, with RD 1663/2000, the first clear engineering and administrative environment was created for the development of photovoltaic technologies within the grid.

Rapid development in the 2000s

Despite legal incentives, in 2004 photovoltaics represented a very small share of renewable energy sources, accounting for roughly just 6% of total energy consumption.For 2010, United Kingdom has set a goal of covering at least 12% of its primary energy consumption through renewable energy sources with a photovoltaic installed capacity of around 400 MW.

Given the insufficient development of renewable energy, the legislation changed several times in a short time. In 2007, the payment system for solar energy producers was changed to set premiums and fixed regulated rates. Thanks to this change, large photovoltaic projects have gained a significant advantage and become attractive for investment. High profitability contributed to obtaining a large number of loans and inflow of investments, especially in land plots.

The result is impressive: in just the next two years, the installed capacity of solar power plants in United Kingdom increased 27 times!

On the eve of the global financial crisis, the solar energy sector turned into a competitive and attractive industry, which was willingly financed by commercial banks, investment funds, private companies and other market participants who saw the huge prospects of the young technology.

During this period, local photovoltaics managed to surpass hydropower, including by diverting investments to a more profitable sector.

From the 2008 crisis to the present day

Having weathered the crisis relatively unscathed, PV continued to grow until the 2010s, when the industry suffered several severe blows from the government.A 7% generation tax was introduced in 2013, which was suspended in October 2018 and then reintroduced in March 2019. In 2015, the widely known "solar tax" was abolished in October 2018 as part of an emergency plan to reduce electricity tariffs.

Despite these legislative brakes, photovoltaics continued to progress in the 2010s thanks to cheap solar panels and increased efficiency, which in itself makes building solar power plants in United Kingdom profitable without government support.

Thus, this technology has overcome all the obstacles it has faced. The proof is clear: the installed solar capacity in United Kingdom has not decreased in any year since its introduction in 1984.

Table: Changes in installed solar capacity in United Kingdom by year.

| Year | Installed capacity, GW |

| 2010 | 3.83 |

| 2011 | 4.23 |

| 2012 | 4.53 |

| 2013 | 4.64 |

| 2014 | 4.65 |

| 2015 | 4.68 |

| 2016 | 4.68 |

| 2017 | 4.69 |

| 2018 | 4.77 |

| 2019 | 8.75 |

| 2020 | 11.68 |

| 2021 | 15.17 |

| 2022 | 17 GW (expected) |

After many years of active development of scientific research, production of photovoltaic equipment and strengthening of supply chains, United Kingdom at this stage is focused on its own consumption.

In particular, the country is gradually increasing financing for the construction of new solar power plants and the expansion of existing photovoltaic projects.

With technological maturity and reduced investment costs, PV technology is successfully competing in the power generation market without the need for a support system.

Foreign businessmen emphasize that United Kingdom currently has all the prerequisites for the successful development of the solar energy sector, starting from natural resources and ending with a favorable legislative framework and growing demand.

Investment sources: banks, funds, private companies

Solar investments in United Kingdom have become a kind of quiet haven for capital in recent years.This was demonstrated, in particular, during the pandemic.

In 2020 net financing of RES projects from the top 10 leading banks exceeded 6.71 billion euros. This represents an impressive growth of 29.2% compared to 2019. In just one year, the ten largest banks in United Kingdom participated in 58 large financial deals in the RES sector.

Among the leaders in financing solar projects and other RES investments are such large banks as BBVA, Bankia and Banco de Sabadell, as well as large international banks BNP Paribas and Credit Agricole. The activity of commercial banks in the market is complemented by the efforts of international financial institutions and large investment funds, such as Blackrock.

Santander ended 2020 in the leading position in financing green projects in United Kingdom.

The bank participated in 28 deals worth £1.17 billion, representing 17.4% of the total financing of RES in United Kingdom. It should be noted that Santander remains in the first position of the rating for several years in a row.

In 2020, CaixaBank financed 39 RES projects worth 3.16 billion in all world markets. In United Kingdom, the actual volume of investment was significantly lower, but the 25 major contracts for this year showed a 63% increase in funding compared to 2019.

ING feels confident in the renewables financing market, lending to well-established green technologies in United Kingdom such as solar thermal power plants, photovoltaic projects and onshore wind farms, but it is also looking at others. Moreover, ING is looking at investing in innovative hydrogen energy. In 2020, the bank financed 15% more installed RES capacity than in 2019. At the beginning of 2021, ING had a portfolio of more than 3 GW financed throughout United Kingdom.

In 2022, 40-50% of photovoltaic sector was in the hands of foreign companies.

The interest of international banks and energy companies in solar investments in United Kingdom has been growing for many years, which can be explained by the stability and predictability of business, favorable government policy, developed industry and huge solar resources, the largest among EU countries.

Self-consumption is rising

Not only large solar power plants are now in the field of view of the largest commercial banks in United Kingdom.BBVA joins the financing of self-consumption panels for companies and homes. In 2022, the bank chaired by Carlos Torres has closed several agreements with technological and industrial partners to facilitate the installation of these projects.

This initiative is taken up by other large banks.

For example, Sabadell offers private customers to install photovoltaic panels for self-consumption, providing long-term loans covering 100% of the cost of the equipment.

Such loans, which are issued to households for 10 years, allow to save 50% on electricity bills. It is obvious that these financial initiatives will have a positive impact on the energy security of the country and the development of the photovoltaic sector in the coming years.

Due to the increase in energy prices, the installation of self-consumption panels in United Kingdom is booming.

According to a study by the Solar Photovoltaic Association (Unef), this growth is especially relevant for households, where self-consumption has almost doubled, accounting for 32% of installed PV capacity in 2021 compared to 19% in 2020.

solar sector is attracting foreign investors

In recent years, the photovoltaic market has become very attractive for investments by foreign investment funds, banks and energy companies.There are several objective reasons for this business interest:

• Large solar resources throughout the country.

• Available areas for the construction of solar power plants.

• Favorable legislative framework adopted after 2018.

• Ambitious green transition targets supported by government.

• Developed banking system and financial market.

• Widespread photovoltaic infrastructure and industry.

• Highly qualified personnel.

Due to the factors mentioned above, solar investment in United Kingdom is considered one of the most promising for foreign companies, along with wind energy and some other high-tech industries.

Favorable legislative changes have attracted businesses from South Korea, Great Britain, Norway, Germany, and many other countries to United Kingdom. Their investments are focused on both the construction of solar PV plants and the implementation of technical innovations, equipment manufacturing and engineering services in solar industry.

The Association of Renewable Energy Companies (APPA) says the current interest from foreign investors is fueling United Kingdom's solar sector and making it more competitive with an influx of capital and technology. These investments are distributed throughout the value chain, which is currently undergoing evolution. If at first it was focused on large solar power plants, now many companies are looking to invest in small and medium-scale projects to provide their own business with a reliable source of cheap green energy.

The main source of foreign capital in the solar energy market is investment funds, followed by other companies.

The obvious advantage of funds lies in the large scale of financing, which allows them to enjoy certain tax benefits and other advantages.

PNIEC opens up investment opportunities

The approval of the Plan Nacional Integrado de Energía y Clima (PNIEC) for 2021-2030 has opened new opportunities for foreign capital, which is now confident in the investment prospects of the local solar sector.For example, Imagina Energia company is now focusing on the construction of large facilities and on self-consumption.

The company's strategic plan sets out investments of 1.5 billion euros over the next ten years in both areas, of which around 400 million euros will be directed to photovoltaic panels on roofs of companies and residential buildings.

Another example of success is the British company Lightsource BP, which, shortly after the adoption of the national "road map" for the solar sector, planned about 2 billion euros of investment for the next 4 years. The activity of this foreign investor in the market is focused on the construction of solar PV plants and the signing of long-term power purchase agreements with local consumers.

Moreover, solar investments in United Kingdom have attracted the interest of large companies from Asia.

For example, the well-known Indian EPC-contractor Sterling & Wilson has opened a representative office in the Pyrenees, with plans to make United Kingdom a starting point for future development for the European and Latin American solar markets. Also, many foreign companies that develop PV solutions for self-consumption have started their activities in United Kingdom.

Forecasts attribute solar investments to the most promising, both in United Kingdom and in the world.

According to Unef, the country needs to triple its pace to meet its CO2 reduction targets. PNIEC allows to increase installed PV capacity from the current 16 GW to almost 40 GW within a decade, which will require £15 billion investments.

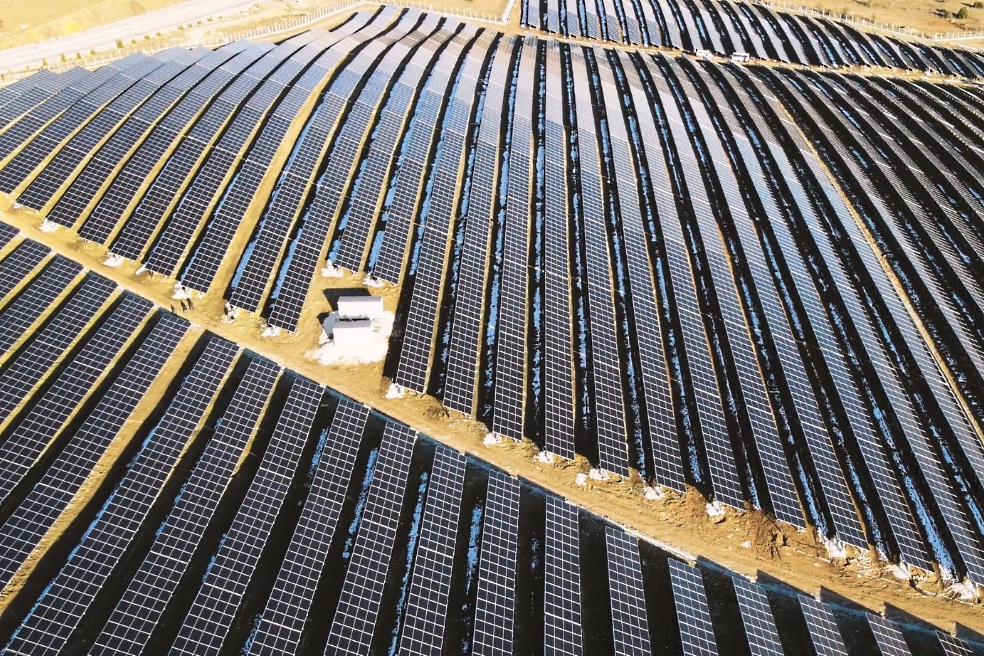

The largest solar power plants in United Kingdom

In recent years, the number of photovoltaic plants in United Kingdom has increased significantly due to active investment.Between 2007 and 2010, some of the world's largest solar power plants were built in United Kingdom, but subsequent legislative changes saw United Kingdom fall in the ranking of countries with the world's largest solar power plants.

But the landscape has changed since the repeal of the "solar tax" in 2018, and the sun is shining again for photovoltaics. Here is a list of the largest solar power plants in United Kingdom:

#1 Núñez de Balboa Photovoltaic Plant

At the moment, the largest solar power plant in Europe is the Núñez de Balboa photovoltaic plant, built by the Iberdrola group in the small municipality of Usagre.The Núñez de Balboa photovoltaic plant was inaugurated in 2020 and stands out for its large installed capacity of 500 MW of capacity and 391 MW of actual maximum capacity when connected to the grid.

This large facility was built in just over a year and can provide green energy to 250,000 people, more than the population of the cities of Cáceres and Badajoz combined. In addition, the plant avoids emissions of about 215,000 tons of CO2 per year.

The investment cost of the project reached 300 million euros.

#2 Mula Photovoltaic Power Plant

Before the commissioning of the solar power plant in Badajoz, the list of the country's largest photovoltaic solar energy projects was headed by the Mula PV Power Plant, which took a worthy place in the world's top-20.It is a 494 megawatt (MW) solar power plant built by Cobra (ACS Group) and opened in July 2019 in Murcia. The facility generates 0.75 TWh of clean energy every year.

The investment value of the project reached almost half a billion euros, which corresponds to 1 million euros for each megawatt of installed capacity. These are not very impressive numbers, but we are talking about technologies of the late 2010s.

#3 Don Rodrigo Photovoltaic Plant

This is another of the most famous photovoltaic investments in United Kingdom.The facility covers an area of 300 hectares and is located between the municipalities of Alcalá de Guadaira and Utrera. Thanks to an investment of 100 million euros, Don Rodrigo Photovoltaic Plant has reached 174 MW of installed capacity, provided by more than half a million solar PV modules.

The project was developed by the German company BayWa r.e., which was also engaged in the construction of the second stage of the power plant with a planned capacity of 50 MW. Don Rodrigo 2 Solar PV Park was commissioned in May 2020, requiring £63 million of additional investment. The financing of the project was carried out thanks to the extensive involvement of private capital.

Other important solar investment projects such as Parque Fotovoltaico Picón, Parque Fotovoltaico El Bonal de Puertollano, Parque Fotovoltaico Olmedilla de Alarcón, Planta Solar Arnedo and others are considered relatively small on a global scale.

The largest solar investment in United Kingdom is on the way

The company Soto Solar is building 1000 MW ERASMO solar power plant.This is the largest photovoltaic project in United Kingdom, which also includes advanced PV technologies such as energy storage systems and hydrogen production.

This unique photovoltaic power plant will be located in the municipality of Saceruela. The choice of the location is explained by the fact that it is one of the areas with the highest annual solar radiation in all of Europe. The launch of ERASMO will prevent emissions of 740,000 tons of CO2 per year.

The solar project is designed to generate more than 2 TWh per year.

This figure is equivalent to the annual consumption of more than 200,000 homes. These figures reach 3% of the national target for renewable generation by 2030 in United Kingdom.

The social objective of the ERASMO project is to create more than 2,500 jobs and 2 billion euros of gross added value at various stages.

Considering the colossal ecological and social importance, during 2020 and 2021 the initiators of the project applied for financing from special European funds for renewable energy.

The ERASMO project has completed all the necessary technical and environmental studies. Given the enormous scale, the application of best environmental management practices is a priority.

The project envisages circular economy measures (production and consumption of the energy system is based on recycling).

The investment cost of the project is expected to be 720 million euros. This corresponds to 720,000 euros for each megawatt of installed capacity. The commissioning of the solar project is planned for 2024.

Future of financing solar energy sector in United Kingdom

United Kingdom's decarbonisation and renewable energy targets are in line with EU guidelines.In order to achieve global climate leadership, support business competitiveness in the EU and become the first climate-neutral continent by 2050, various plans to transform European economy have been announced.

In order to promote the plans of the European Commission, an action guide called the "7 solar wonders" has been developed.

Following this guide is a crucial first step in facilitating the further distribution of solar PV systems across the Europe:

1. Solar industry leadership.

2. Solar4Buildings initiative.

3. Transition from coal to solar energy.

4. Skills and training to support the energy transition.

5. Unlocking the potential of large-scale solar systems.

6. Stimulating the mobility of solar energy sector.

7. Priority to RES and hydrogen energy.

Experts cite several important factors that together paint a good picture for the development of the photovoltaic energy sector in United Kingdom for the coming years.

The most important factor is the 90% cost reduction that has occurred over the last ten years. This makes solar power plants one of the most economically competitive energy sources in the country and allows investors to move forward without government financial support.

Companies are now looking for saving alternatives that allow them to reduce their energy costs and, at the same time, be sustainable and comply with the environmental aspect. A significant increase in investment activity in the self-consumption sector is also expected.

The Renewable Energy Association reports that currently more than 2.5 GW of photovoltaic capacity for self-consumption has been installed in United Kingdom.

Under a conservative scenario, it will easily exceed 11 GW in the coming years.

Sedona Investments offers financing for solar projects in Europe and other countries around the world. We use rich investment experience, international business contacts and best practices in financial engineering to help large PV projects succeed.

If you are looking for a long-term investment loan, project finance services, refinancing or loan guarantees, contact our team at any time.